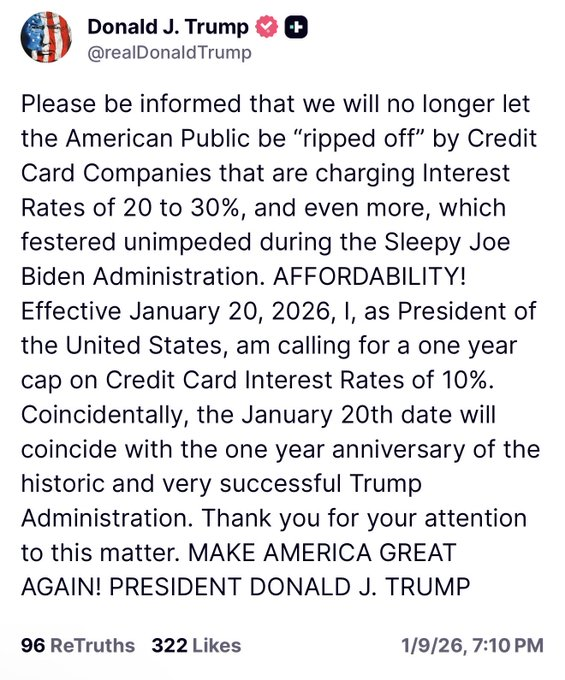

President Donald Trump announced via Truth Social that he will implement a 10% cap on credit card interest rates effective January 20, 2026—the one-year anniversary of his inauguration—calling current high rates a “rip-off” that flourished under the Biden administration. The declaration comes as average U.S. credit card interest rates hover near 23% and Americans carry $1.16 trillion in credit card debt, reviving a proposal Trump floated during his 2024 campaign.

The move aligns with existing bipartisan legislative efforts, including the 10 Percent Credit Card Interest Rate Cap Act, which has been introduced in Congress. However, implementation of Trump’s proposed cap would require either congressional approval or action by the Consumer Financial Protection Bureau (CFPB), presenting significant procedural hurdles for the initiative.

While supporters argue the cap would provide substantial relief to borrowers struggling with high-interest debt, the financial services industry has warned that such restrictions could lead to unintended consequences. Industry representatives caution that a rate ceiling could result in reduced credit access for consumers, particularly those with lower credit scores, as well as increased fees in other areas as lenders seek to offset lost revenue from capped interest rates.